MI TD F 90-22.53 1999-2024 free printable template

Show details

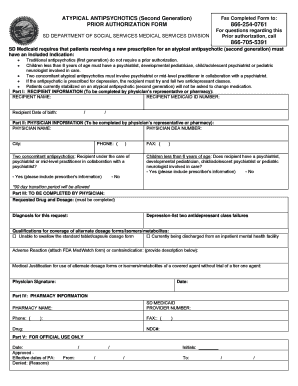

TD F 90-22.53 Treasury form Designation of Exempt Person Please type or print 2 Check appropriate box an Exemption Amended b Exemption Revoked OMB No. 1506-0012 b Biennial Renewal (January 1999) 1

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form td f 90 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form td f 90 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form td f 90 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form td f 90. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

How to fill out form td f 90

How to fill out form td f 90:

01

Start by carefully reading the instructions provided with the form. These instructions will guide you through the process and provide any necessary details.

02

Gather all the required information and documents before you begin filling out the form. This will help ensure that you have all the necessary information readily available.

03

Begin by entering your personal information accurately. This may include your full name, address, contact information, and any other required details.

04

Follow the instructions on the form to complete each section. Provide the requested information accurately and clearly. Use black or blue ink to fill out the form, unless specified otherwise.

05

Double-check all the information you have entered on the form. Make sure that there are no errors or missing information. Ensure that you have appropriately signed and dated the form, if required.

06

Review all the instructions one more time to ensure that you have completed the form correctly. Make any necessary corrections before submitting it.

Who needs form td f 90:

01

Form TD F 90 may be required by individuals or businesses who need to report the transportation of currency or monetary instruments across the United States' borders.

02

It is typically required by customs and border protection authorities as a means of preventing illicit financial activities like money laundering and terrorism financing.

03

Individuals or businesses that frequently engage in international travel or trade or those who are carrying large sums of money or monetary instruments may be required to fill out form TD F 90.

Please note that it is important to consult the specific instructions and regulations regarding form TD F 90 to determine if and when it is necessary for your particular situation.

Fill form : Try Risk Free

People Also Ask about form td f 90

What is an exempted person?

What is TD F?

What is td f 90 22. 1?

What is a .TDF file?

Which one of the following may be treated as an exempt person?

What is a designation of exempt person form?

What is a non-listed business?

What is a TD 90?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form td f 90?

Form TD F 90 is the Federal Telework Training Agreement, used by federal agencies to document an employee's agreement to complete telework training. It is part of the telework program for federal employees, which allows them to work remotely or from home. The form outlines the terms and conditions of telework training, including the training requirements, responsibilities of the employee and supervisor, and any additional agreements or conditions for teleworking.

Who is required to file form td f 90?

Form TD F 90 is required to be filed by individuals who are leaving Canada for over 183 days or those who are deemed to be non-residents for tax purposes.

What is the purpose of form td f 90?

Form TD F 90, also known as the Treasury Department's Schedule of Excess Currency Held Abroad, is used to report the amount of U.S. currency held by U.S. financial institutions outside the United States. The purpose of this form is to collect information on the amount of excess currency held abroad by these institutions, which is essential for the Treasury Department to monitor and manage the supply of U.S. currency in circulation. This information is used for statistical purposes as well as to facilitate monetary policy decisions and actions.

What information must be reported on form td f 90?

As of my knowledge, there is no specific form called TD F 90. However, if you are referring to a different form, please provide more details or context so that I can assist you better.

How to fill out form td f 90?

Form TD F 90 is used by the United States Department of the Treasury to report funds received for transportation services provided to the federal government. Here's a step-by-step guide on how to fill out this form:

1. Download and print out a copy of Form TD F 90 from the official Treasury website or obtain a physical copy from your employer/government agency.

2. Start by entering the reporting period in the "Period Covered" field at the top of the form. This should include the month, day, and year.

3. Provide your complete business name, address, and Taxpayer Identification Number (TIN) in Section A - Vendor Information. If you have an Employer Identification Number (EIN), include it here.

4. In Section B - Voucher Number, enter the invoice or voucher number associated with the transportation service provided. If there is no voucher number, write "None".

5. In Section C - Obligation Number, provide the unique number assigned to the transportation service contract or agreement.

6. Section D - Agencies, requires you to list all the federal agencies for whom the transportation service was provided. Include the agency name, agency code, date of service, and the amount charged for each agency. If the space provided is not enough, you may attach additional sheets.

7. Next, calculate the total amount for each agency and enter it in the "Total" column provided.

8. In Section E - Certification, sign and date the form, certifying that the information provided is true, accurate, and complete.

9. If you need to make any additional notes or explanations regarding the amount claimed or any other aspects, you can do so in Section F - Remarks.

10. Make a copy of the completed form for your records before submitting it to the appropriate government office or department.

Always ensure that you accurately complete all the required sections of the form, double-checking for errors or missing information. If you are unsure about any specific details while filling out Form TD F 90, consult with your employer or a tax professional for guidance.

How do I edit form td f 90 online?

With pdfFiller, it's easy to make changes. Open your form td f 90 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I edit form td f 90 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute form td f 90 from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete form td f 90 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your form td f 90. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your form td f 90 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.